Explain Working Capital and Different Components of Working Capital

Concepts of Working Capital 3. Based on the above steps we can see that the working capital cycle formula is.

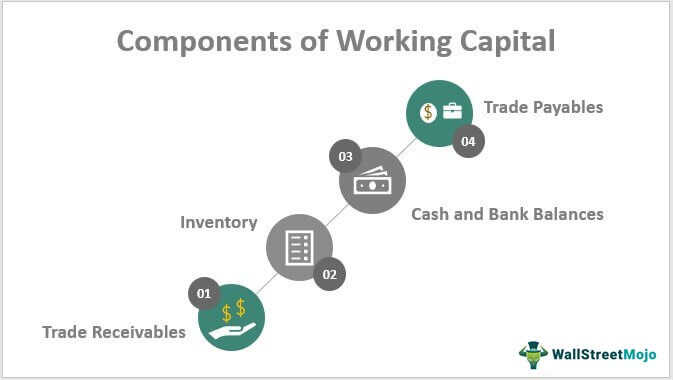

Components Of Working Capital Top 4 Detailed Explained

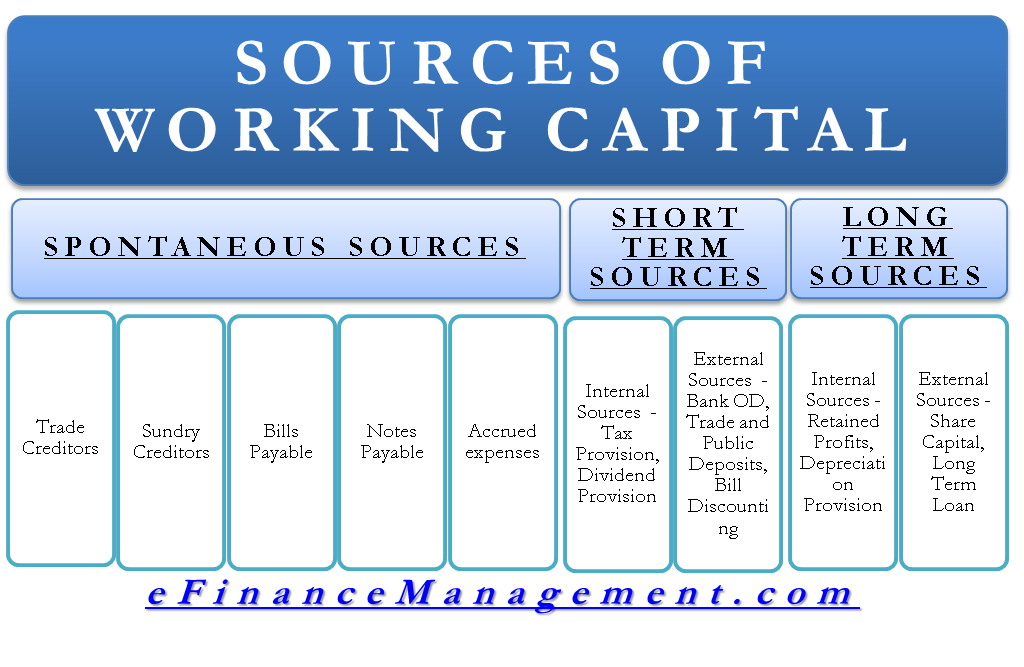

A company has to tie up money to fund its stocks credit sales and other current assets but this is offset by its ability to fund this from current liabilities liabilities such as purchases on credit.

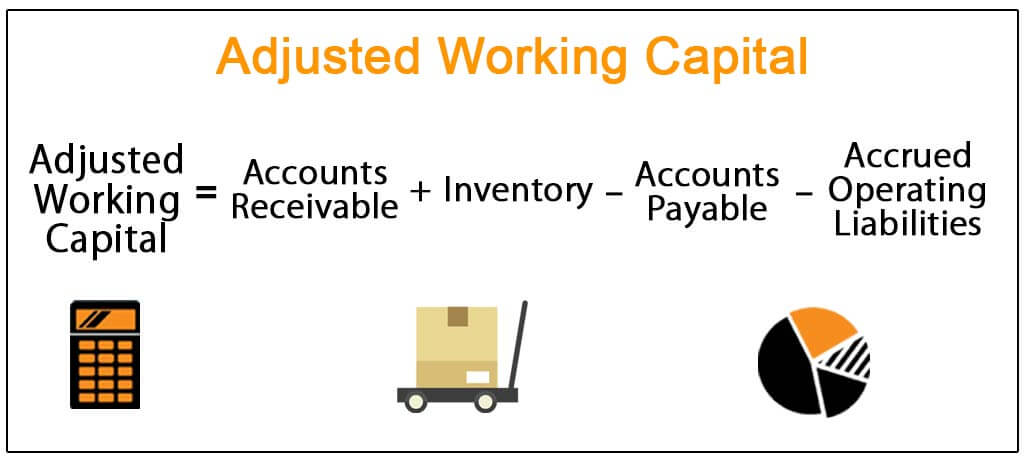

. Now that we know the steps in the cycle and the formula lets calculate an example based on the above information. Accounts Payable Accounts payable is the amount that a company must pay out over the short term and. The gross working capital has some.

Working capital is the cash and assets available to a company to cover its short-term liabilities. Permanent working capital implies the base investment amount in all types of current resources which is respected at all times to carry on business activities. The term receivable is defined as any claim for money owed to the firm from customers.

The below mentioned article provides a study note on Working Capital- 1. Current assets generally mean those assets which in the normal and ordinary course of business will be or are likely to be converted into cash within a year. Gross Working Capital.

Advantages of High Working Capital. It is needed for performing all the. Working capital is that part of a firms capital which is required to hold current assets of the firm.

Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. The gross working capital is the amount of a companys total investment in current assets. The former is when your companys current assets exceed its current liabilities.

Cash inventory accounts receivable trade credits marketable securities loans Insurances etc. Adequate but Not Excessive. Payable days 90.

The capital invested in these assets is referred to as Working capital. Working Capital Cycle 85 20 90 15. Accounts Receivable Accounts receivable are revenues duewhat customers and debtors owe to a company for past sales.

Working Capital 80000. Tandon committee has referred to this type of working capital as Hard Core Working Capital. They are several main components of working capital management.

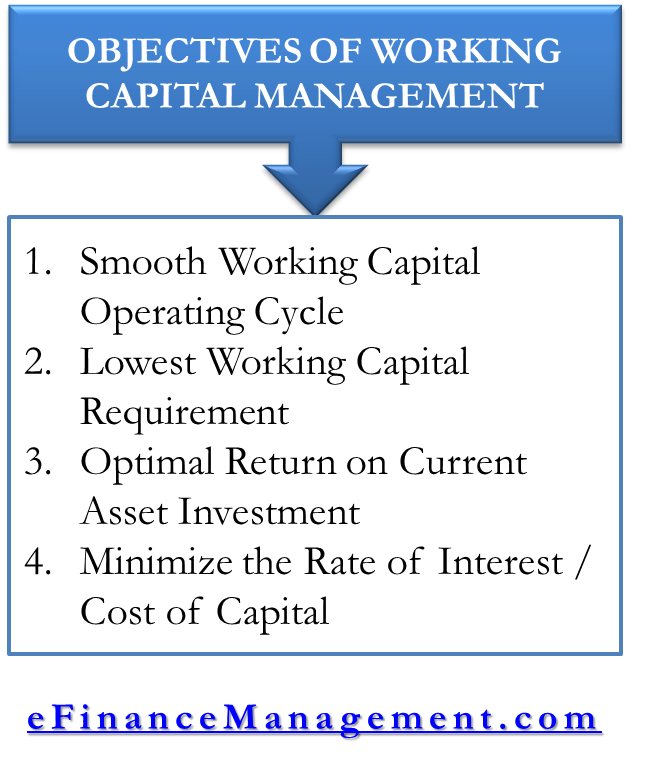

Cash is one of the important components of current assets. These are three main components associated with working capital management. Working Capital Management WCM refers to all the strategies adopted by the company to manage the relationship between its short term assets and short term liabilities with the objective to ensure that it continues with its operations and.

Gross and Net Working Capital. Working Capital is one of the most important components of business. It can be further divided into positive net working capital and negative net working capital.

Operating working capital OWC refers to a companys current assets and measures the amount of investment a company needs to fund components of their operating cycle or day-to-day operations. Gerstenbergh defines it as The excess of current assets over current liabilities. Working Capital Cycle Formula.

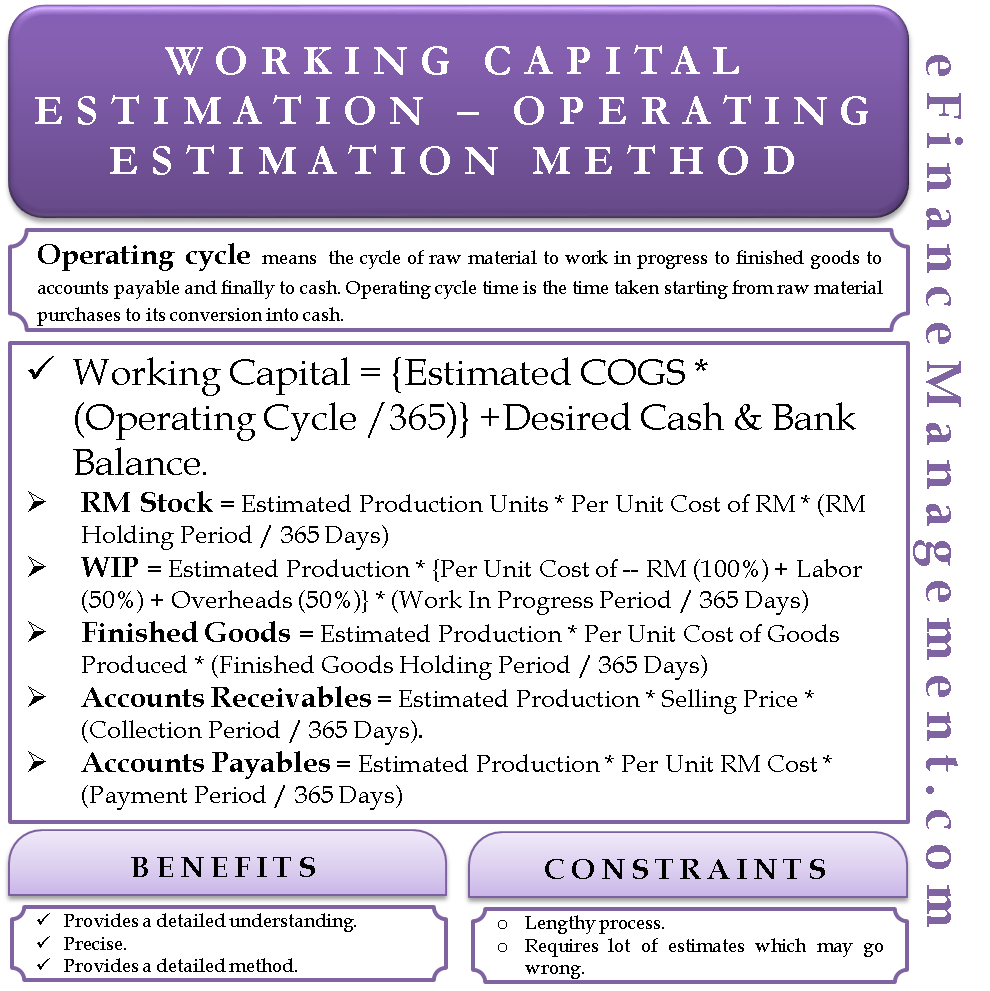

Businesses cannot think of functioning without sufficient working capital to meet their day-to-day needs. According to the reports mentioned its working capital can be estimated with the help of the formula. Meaning and Components Business Components of Working Capital.

The concept of working capital is viewed differently by leading authorities. Whereas excessive working capital results in increased cost for the business. Many factors can impact a companys cash flow but one of the.

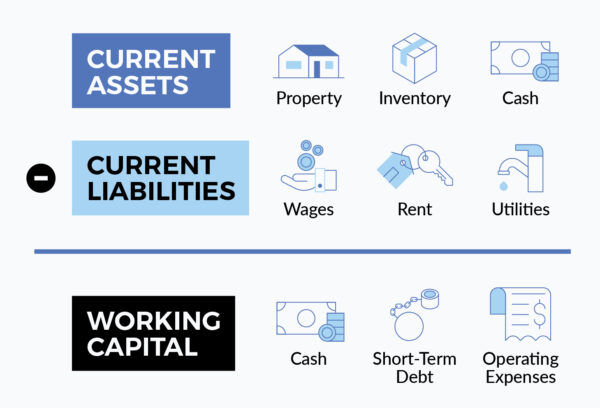

Working capital Current Assets Current Liabilities. This process includes buying and selling inventory paying suppliers and collecting payments from customers. The difference between current assets and current liabilities is known as cash flow.

The balance sheet view divides working capital into gross working capital and net working capital and the operating cycle view divides the working capital into permanent and temporary working capital. Or you can say that the total amount of short-term capital needed to run the business operations is called gross working capital. For example the total amount of raw material finished goods receivables and cash.

Receivable days 20. Permanent and Temporary 4. Working Capital 300000 220000.

There are two components of working capital viz current assets and current liabilities. Current assets are those assets which are convertible into cash within a period of one. In other words its the money a firm has on hand to pay its bills and keep its operations going.

Some authorities consider working capital as equivalent to excess of current assets over current liabilities. Inventory days 85. Meaning of Working Capital 2.

Working Capital Definition and Factors Affecting Working Capital Working capital is the amount of money that a company has tied up in funding its day-to-day operations. Generally the working capital has its significance in. Working Capital Current Assets Current Liabilities.

4 Main Components of Working Capital Explained. Working Capital is divided into various types based balance sheet view and operating cycle view. Net working capital is the difference between your companys current assets and current liabilities as per its balance sheet.

Working Capital Cycle Sample Calculation. Let us understand some of them below. The working capital formula is.

Meaning of Working Capital. Permanent working capital is further divided into seasonal and. Types of working capital.

The working capital formula tells us that short-term liquid assets have been repaid after short-term liabilities. It is a measure of the short-term liquidity of a company and is important for financial analysis financial modeling and cash flow management. Cash is the most liquid form of funds hence it is one of the huge important components of working capital.

It is otherwise called as Fixed Working Capital. Insufficient working capital amounts to a shortage of resources. Thus the Calculate Working Capital of XYZ is Rs 80000 for that financial year.

Working Capital Ratio Analysis Example Of Working Capital Ratio

Difference Between Fixed Capital And Working Capital Top 8 Differences

Working Capital Cycle Efinancemanagement

Working Capital What Is It And Why Do You Need It Business 2 Community

Working Capital Cycle What Is It With Calculation

Working Capital What Is It And Why Do You Need It Business 2 Community

Working Capital Estimation Operating Cycle Method

Working Capital What Is Working Capital Definition Meaning

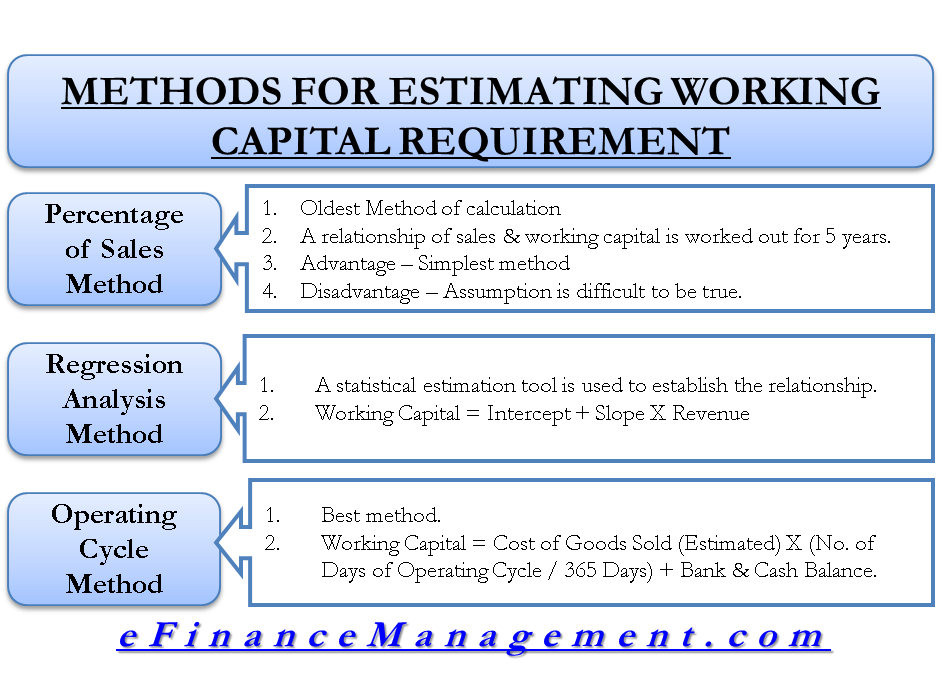

Methods For Estimating Working Capital Requirement

Working Capital Cycle Definition How To Calculate

Objectives Of Working Capital Management

Working Capital What Is It And Why Do You Need It Business 2 Community

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Types Of Working Capital Gross Net Temporary Permanent Efm

Working Capital What Is It And Why Do You Need It Business 2 Community

Working Capital Cycle Understanding The Working Capital Cycle

Difference Between Fixed Capital And Working Capital Top 8 Differences

Comments

Post a Comment